Senior Freeze Exemption For Tax Year 2025 Due Date

Senior Freeze Exemption For Tax Year 2025 Due Date. A senior or super senior who earns more than the exemption amount is still required to pay taxes even though they are not required to file an income tax return. Each year, the supervisor of assessments will mail annual renewal applications to those senior taxpayers currently.

A senior or super senior who earns more than the exemption amount is still required to pay taxes even though they are not required to file an income tax return.

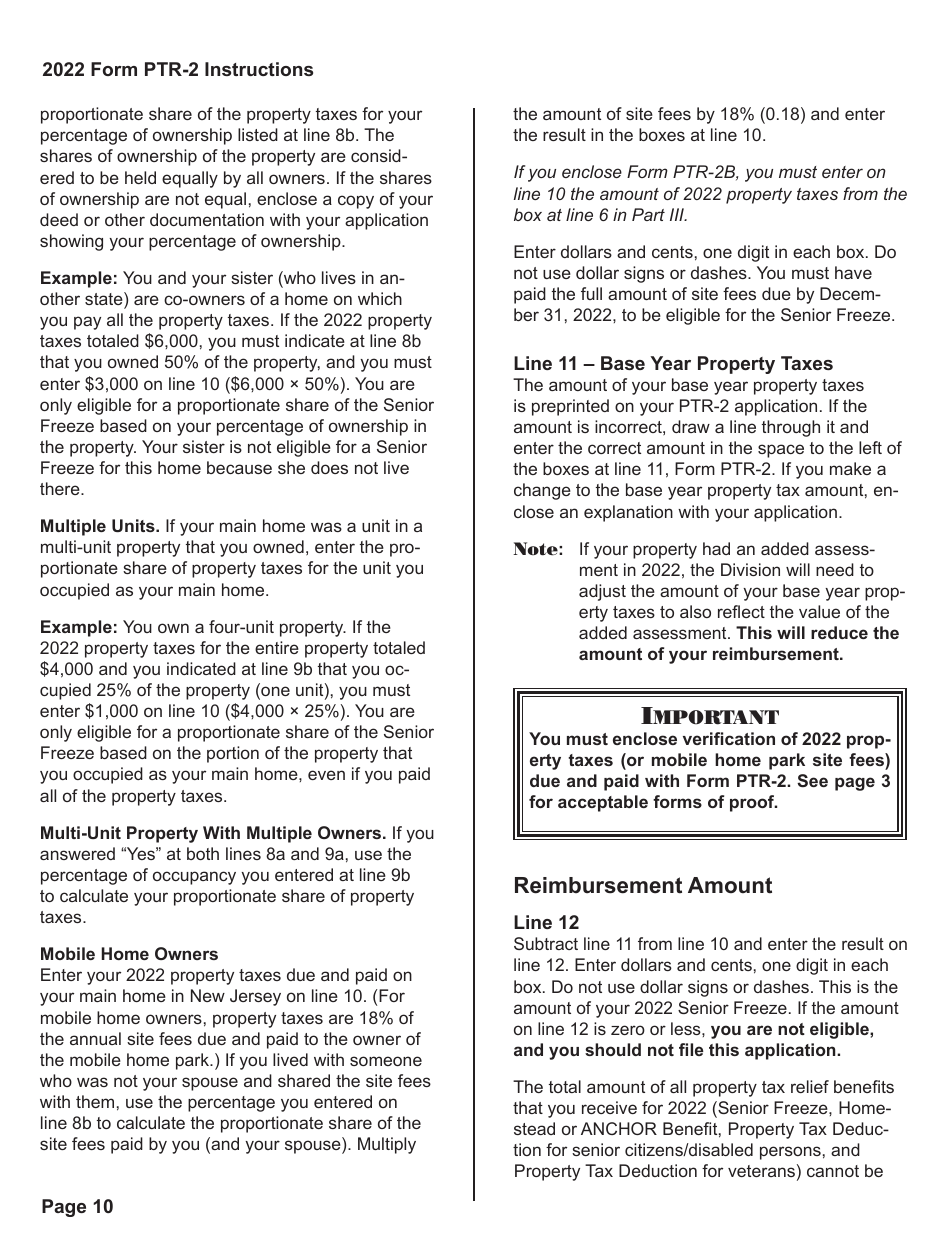

Fillable Online Senior Citizen Assessment Freeze Exemption Kane, According to the department of the treasury, applications are being mailed to the last address from. If you moved to your current home between january 1, 2025, and december 31, 2025, and you applied and were eligible for a reimbursement for property taxes (or mobile.

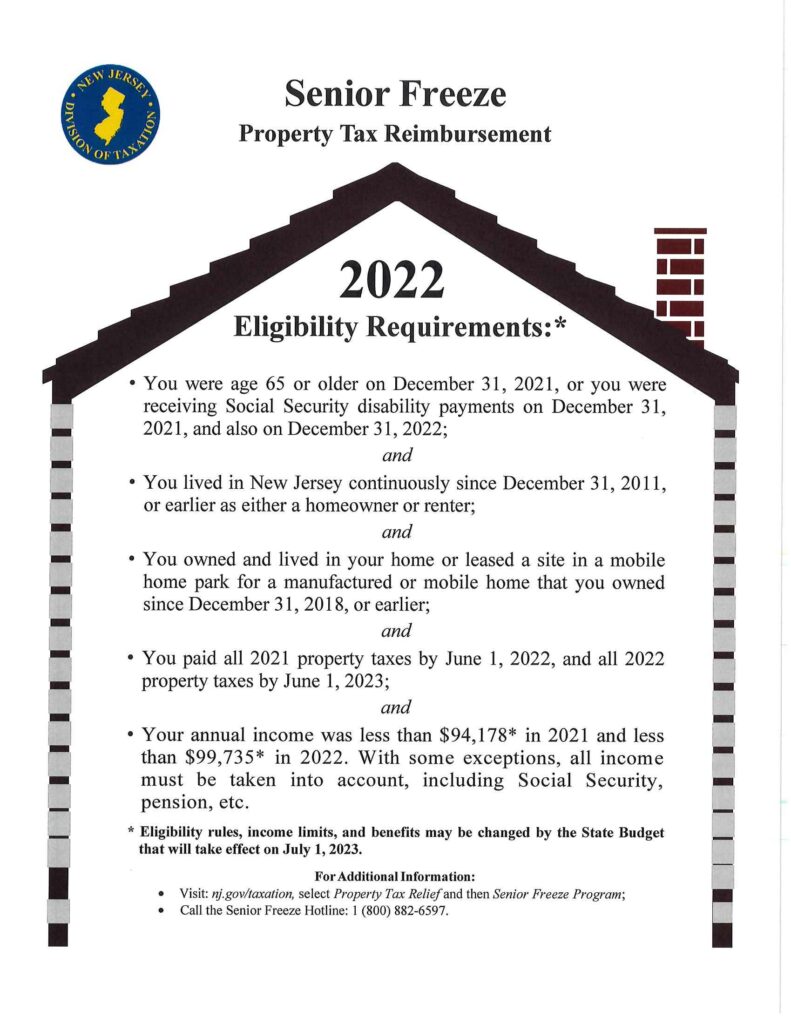

Senior Freeze Property Tax Reimbursement 2025 Eligibility, The deadline to file applications is oct. Nj senior freeze property tax relief for 2025.

Fillable Online Fillable Online senior freeze exemption for tax year, A senior or super senior who earns more than the exemption amount is still required to pay taxes even though they are not required to file an income tax return. The deadline to apply for the senior freeze property tax reimbursement program is oct.

Download Instructions for Form PTR2 Senior Freeze (Property Tax, The 2025 property taxes due on your home must have been paid by june 1, 2025, and the 2025 property taxes must be paid by june 1, 2025. Late filers face increased scrutiny from tax authorities.

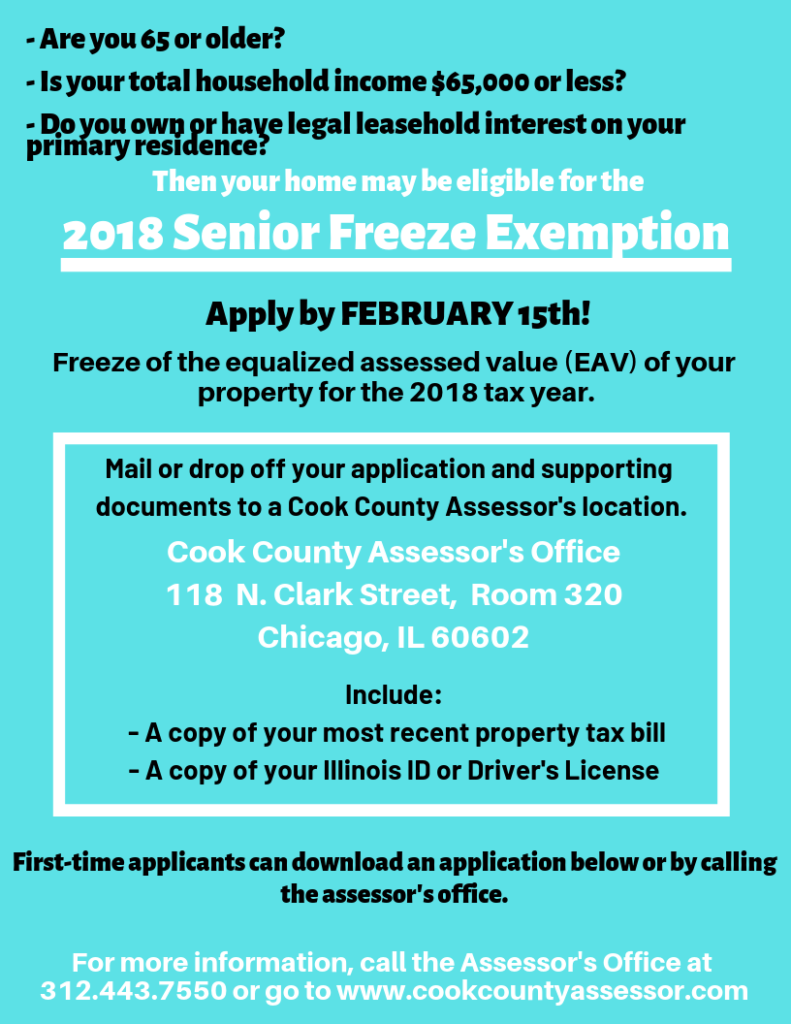

Property Taxes Improving the “Senior Freeze” Program Troy Singleton, Nj senior freeze property tax relief for 2025. What does this exemption do?

Deadline Extended for Property Tax Exemptions! Alderman, If you previously received senior freeze reimbursements and the only reason you are no longer eligible for the program is. Seniors aged 65 and older with an annual household.

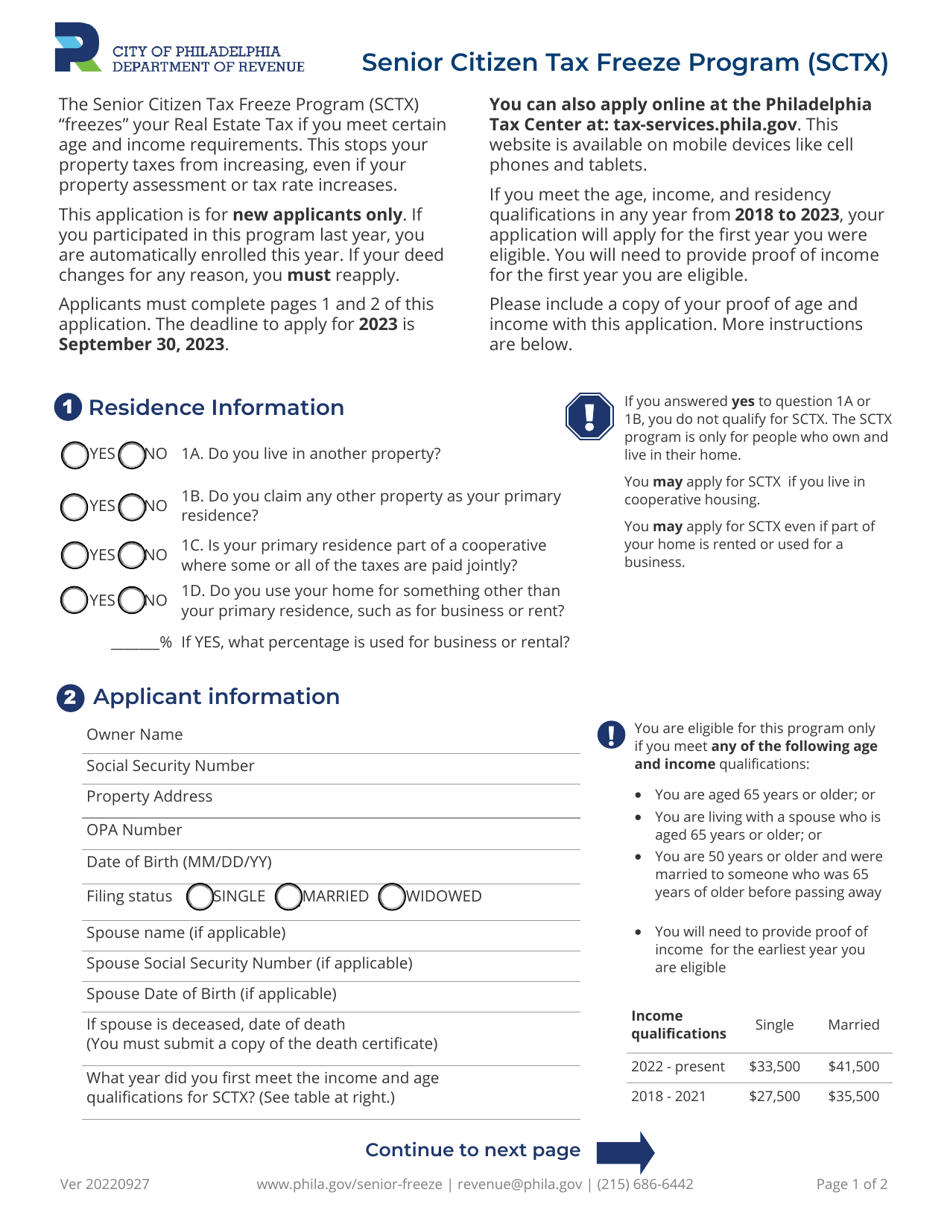

Fillable Online Senior Citizen Assessment Freeze Homestead Exemption, It had not been extended till. Applicants must meet certain age and income requirements to qualify for the “senior freeze” exemption.

Tax credits could replace senior freeze rebates • New Jersey Monitor, Late filers face increased scrutiny from tax authorities. A senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible property.

DEADLINE TODAY Cook County Senior Citizens Assessment, What does this exemption do? According to the department of the treasury, applications are being mailed to the last address from.

2025 City of Philadelphia, Pennsylvania Senior Citizen Tax Freeze, It had not been extended till. The 2025 property taxes due on your home must have been paid by june 1, 2025, and the 2025 property taxes must be paid by june 1, 2025.

The deadline to freeze administrative boundaries of districts, tehsils, towns, municipal bodies among others ended on june 30, 2025.